Updated on June 9, 2022

Are you winning?

Have you been winning so far working in a SaaS startup? Can you prove it? How do you measure success? Is your sales & marketing effort focused in the right place?

What do you wish you knew about SaaS sales & marketing a few years ago?

Whether you are in the B2B marketing department or part of the sales team, how is your SaaS company’s revenue improving thanks to your contribution? In what areas?

If we are not asking these questions, are we even aware of what we are doing? What is the ultimate goal for our business and how are we measuring success?

Why SaaS sales metrics are so important?

We measure results using Key Metrics, or Key Performance Indicators (KPIs) that drive the SaaS business towards its goal. That’s how we know where to invest our time and effort and therefore nurture sustainable business growth.

After in-depth research in the SaaS industry, I realized that a lot of the newly hired (the beginners) in a SaaS startup don’t quite understand the difference between the traditional business model and the SaaS business model. This results in slowing down the SaaS startup growth rate and brings costly consequences.

That’s why this article came into being, and its purpose is to shed light on the main differences between the most important SaaS Sales & Marketing metrics and their traditional alternatives, explained most simply.

Understanding and acting upon them during your everyday activity will guide you to win in the long run.

David Skok, in his amazing speech on WebSummit, introduced another role of the SaaS Sales metrics, that agrees with Elon Musk’s quote.

“Once you start regularly measuring a series of numbers, what you’ll find is that your team will realize the importance of those numbers and start to work on improving them.”

David Skok

They act as a powerful way in aligning sales, marketing and customer success teams, and therefore your company in the right direction.

Let’s start by understanding the broader perspective from an bird’s-eye view.

Understanding the SaaS business model (and how it works)

Software as a Service (SaaS) is the modern business model of today. Different, unconventional, and fluctuating. It’s a service business.

It is based upon a subscription (delivery) model, where a centrally hosted software is licensed (allows the product to be accessed and used) to customers via monthly or annual subscription plans.

Besides, even the market model is different.

Since the SaaS customer pays month by month, quarterly, or once a year, SaaS businesses have a much more complex sales funnel than the traditional.

Therefore, following the traditional business metrics and KPIs is the greatest mistake among the SaaS community, and apparently the most occurring one.

We at Sales.Rocks (an evolving SaaS business) haven’t been spared from this challenge either. Learning how to adapt to it daily led us to valuable insights from our personal experience that we gladly share with you in this article – I call it: the Smarketing SaaS playbook for beginners.

This post is aimed at everyone working behind the curtains of a SaaS company, with an accent on:

- The Sales Force;

- The SaaS marketers;

- The customer success team;

to help you understand the difference between SaaS’s unique sales funnel and metrics vs. the traditional, which variables really matter.

Practically, we have to unlearn the traditional business key metrics that all of us have been trained in, but which totally fail to capture the key factors that drive SaaS performance.

These are the key SaaS sales metrics that are directly tied to your company’s growth.

The 5 Most Important SaaS sales metrics vs. their Traditional Alternatives

#1. New Sales vs. Net-new customers

Why B2B sales professionals and SaaS marketers need to start focusing on new sales instead of new customers?

The SaaS sales funnel is long, complex, and demands multiple touchpoints with your prospects, true. But that doesn’t mean “more difficult”. It simply requires a different “sales & marketing mindset”.

Here is what Graham Hawkins pointed out in an article a few years ago:

“This relentless pursuit of ‘net new’ customers has blinded many vendor sales leaders to the fact that customer retention is now more important than ever before in this new ‘customer-led era’”.

Graham Hawkins

Why are we working so hard at acquiring “net new” (brand new) customers while there is a goldmine right behind our back? =The existing customers🌟.

- Getting a new customer costs five times as much as keeping an existing one.

- The success rate of reselling to an existing customer is 60-70% whereas the probability rate of selling to a new prospect is 5-20%.

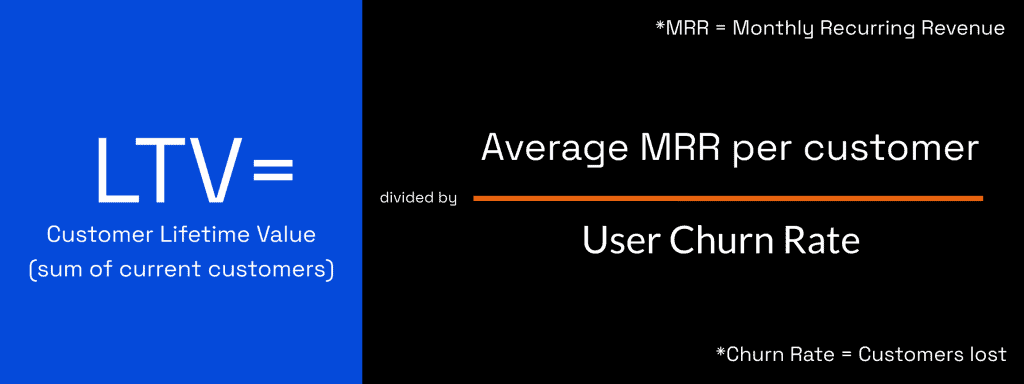

As a recurring revenue business, SaaS is simply different because the revenue for the service is slowly building up over an extended period of time = the customer lifetime value (LTV) – Average monthly MRR per customer / User Churn Rate.

When a user is happy with your service, they will stick around. And then, the profit made from that customer over longer period of time will increase considerably.

On the flip side, if a customer is unhappy, they will churn.

This results in:

Losing the money initially invested in acquiring that customer, CAC – Customer Acquisition Cost.

+

Losing the profit that would have been made if they were properly nurtured and retained.

Therefore, the SaaS working party now has two sales types to strive towards.

- New sales: reselling to existing customers (to maximize the lifetime value);

- Net-New sales: Acquiring brand new customers.

The moral of the story: Smarketing teams (sales + marketing), should be more concerned about reducing the number of current clients that are lost each month to customer churn, instead of focusing blindly on acquiring new ones.

This naturally leads us to the second most important SaaS sales metrics.

#2. The Churn Rate vs. Retention Rate (opposite but complementary)

The SaaS subscription plans offered to customers can vary depending on the pricing strategy. Some SaaS businesses are offering multiple tools/features/modules within their software, and therefore have different subscription plans in giving access to those different services.

I’m sure the product team has been busy and dedicated on designing those additional tools.

Still, it is fascinating that most sales reps never think of their current clients as leads for more new sales.

Upselling.

Opportunity Creation, Future Sale – you name it.

If you keep track of when your existing clients are ready to be sold another product/tool/feature = simply upgrade their subscription plan and initial price, there is your new sale + reduced churn rate + increased revenue.

Simple as that.

These types of renewal SaaS companies accelerate business growth and revenue when customers stay for longer periods of time.

(I believe I already said this a couple of times, but I simply can’t stress the importance enough).

For this reason, Churn Rate & Retention Rate are critical SaaS sales metrics that can either “make or break” a young SaaS company.

The churn and retention metrics are directly tied to MRR (Monthly Recurring Revenue), and ARR (Annual Recurring Revenue). And in a SaaS business, those metrics are the two pillars of measuring your SaaS progress in terms of revenue. Which are basically the essential Sales KPIs in SaaS B2B company.

There are two types of SaaS businesses:

- Those with primarily monthly contracts, usually the small SaaS business, where the primary focus will be on MRR (Monthly Recurring Revenue);

- Those with primarily annual (or even 3-years minimum) contracts, the enterprise company. The primary focus being on ARR (Annual Recurring Revenue), and ACV (Annual Contract Value).

We will focus on the first type, the SaaS startup or SMB.

Here, the ARR is the monthly recurring revenue (MRR) annualized. Recalculated as an annual rate. It can serve as a forecast of how much revenue you can expect your business to generate annually – based on your current MRR.

The formula is pretty self-explanatory: MRR x 12

____________________________________________________

e.g. If your current MRR is $3,000, your ARR would be $36,000 (3,000 x 12).

Bear in mind, this ARR formula just assumes the predicted average number if nothing else changes (no new customers, no churn, just as the MRR is currently). It tells you the predictable revenue for a 12-month period.

Therefore, this is not an honest (universal) ARR formula in the sense that an investor would use it to assess a business value. But it works for the purpose of this article – to get us (the people working behind the scene) to see the bigger picture.

Yes, these metrics are primarily of interest to the SaaS founders, the CEO, or CRO, especially the revenue churn. Nevertheless, it is crucial that sales, marketing, and customer success teams of the SaaS company understand the logic behind them. This brings clarity to the sales process and the sales strategy and helps prioritize the leads>tasks>goals you are aiming to achieve.

Profitability?

ARR & MRR are key contributors to the ultimate business goal of everyone: profitability.

And… guess what, SaaS Churn kills SaaS growth.

Profit only exists when the churn rate is carefully managed and taken care of.

As a Sales Development Representative, if you sell the service to 3 new customers, you are bringing money to your company right? Well, maybe.

But.

If you also lose 3 clients that month, then the answer is no. Your net new sales, in this case, are 0 (zero). All that hard work to find and close those 3 clients and still you did absolutely nothing for the bottom line.

Let’s go a little bit deeper here.

#3. Not all churn is created equal:

Revenue Retention vs. Customer Retention

If I were to ask you which one is more important, I assume the quick answer would be “Revenue Retention”.

And you might be right. We were taught to believe that Revenue is King in any SaaS business. But it’s not that simple.

Actually, they’re Mutually Inclusive. And Customer Retention is the Queen in the SaaS business.

To demonstrate: you may lose five customers with subscriptions of $1,000/mo each for a total of $5,000 in lost revenue (churn),

OR one enterprise, single customer, with a subscription of $8,000/mo.

If we are blindly focused on revenue retention, it may seem better to lose those 5 customers equaling $60.000 in ARR (5 x 1.000 x 12), rather than the one enterprise customer that brings $96.000 in ARR.

Ok. Just keep in mind that those 5 smaller customers lost, when properly nurtured, carry an untapped potential to eventually outrun the bigger “shark” in the long run (revenue-wise) + until then, they still bring you $60.000 ARR which is better to keep than lose.

And finally, they carry additional hidden costs = should you lose them, they may become negative advocates for your brand in the niche market. (The SaaS marketers will “feel me” on this one and the consequences resulting from it).

The market share is not indefinite, neither is the sales target. And customer happiness is kind of a big deal in SaaS. Current Customer = Valuable Customer is the motto of our Customer Success Manager, Ana.

Related read: Stand Out In the B2B SaaS Market: Sell The solution, Not The Technology.

#4. Smarketing + Customer Success team alignment = sustainable revenue growth

In SaaS, most of the sales are B2B centered. The key to the success of this sales model is sales and marketing alignment = Smarketing.

But now that we inserted the churn rate into the mix, (and saw its importance!), it is only logical to include the customer success team for a more rounded and holistic approach to understanding SaaS Sales.

Here is the bigger picture.

– The executive team includes the sales director or CRO and the account executives (AEs). Among other things, their common ground is found in tracking revenue metrics that make up the sales strategy. They analyze the sales pipeline, track and use expense automations, and take care of sales productivity by providing regular training.

– The account managers (AMs) together with the customer success team are on the same quest – nurturing a strong relationship with their existing clients, upselling with an account-based approach, and maintaining customer satisfaction.

– While the SDRs, are primarily focused on Quota Attainment from outbound prospecting and tracking sales qualified leads.

all of them are strengthened by the B2B marketers that fill the lead pipeline with MQLs for the sales team to take over and close. They follow the sales funnel metrics to “greet” the MQLs on every touchpoint until they become SQLs. One of their primary saas sales metrics is lead conversion rate.

“I prefer to monitor Lead Conversion Rate because it’s a direct indicator of our ability to attract the right target audience and the efficiency at which our website turns them into leads.

There might be a variety of visitors coming to your website. Some might be following a link while researching a topic; others may have come through an organic search.

Because you have various visitors at various stages of the buying cycle, you should have multiple lead-capture paths like chatbots for someone visiting the first time, a gated whitepaper for someone looking for more information about your product’s use case, etc.

In either case, measuring lead conversion rate is most important to know how well your content/funnel is working.“

Savan Kharod, Digital Marketer at Acquire.

Alignment of the entire team is the only way to sustainable SaaS business growth.

This can be achieved when the customer success superheroes & heroines 🦸🦸🏼♂️,

together with the sales professionals 👩💼👨💼,

are working hard on reducing and stabilizing the churn rate,

before the stream of fresh new leads driven by the SaaS marketers 🧙♀️👨💻

start flooding your website and converting on your CTA (e.g. Create an account / Demo call request).

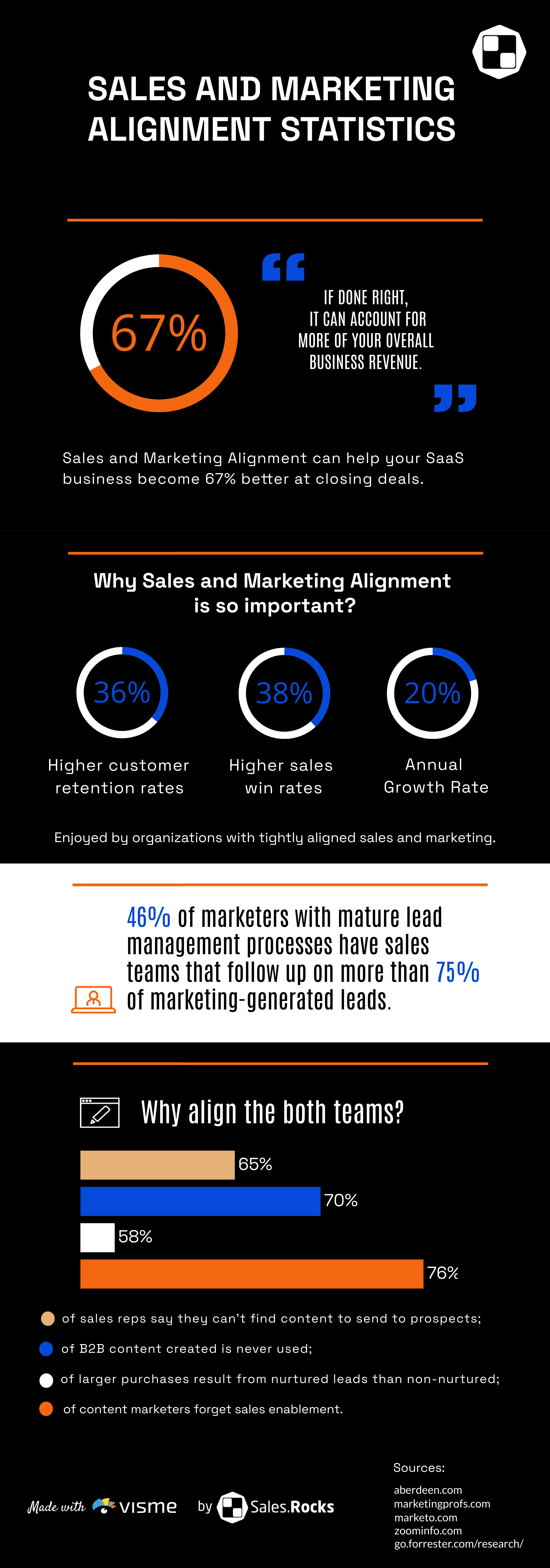

Food for thought: Alignment among sales and marketing teams drastically increases the number of qualified leads coming to your digital property (your website), and improves the Conversion Rate.

#5. The Clash of the Titans: Customer Acquisition (+Cost) vs. Customer Retention

This is the never-ending battle in SaaS startups. Where to focus the scarce amount of resources available to a small business? The success lies in finding the balance between the two. The yin yang.

We talked a lot about the importance of customer retention, for the simple reason that most of us are placing customer acquisition on a pedestal without paying much attention to customer lifetime value.

But there is a reason for it.

Customer Acquisition – increasing the customer base, is the ode to scaling the business. It’s the fastest way to reach short-term revenue goals. But how to balance them both to get the most out of the two worlds?

When we step aside from pure profitability concerns, measuring customer retention is the best way to measure how reliable the company is in providing its service.

Besides, a high customer retention rate can be an amazing driver of customer acquisition in itself, through successful customer referral and testimonials of success stories from satisfied customers.

However, the statistics slap us in the face. They very accurately present our own confusion in what we know to be true (and what really matters) but we still instinctively insist on making a profit (while burning the already made) on net new.

- 44% of companies agree they “have a greater focus” on acquisition, while only 18% admit they focus on retention (the rest claim to have an equal focus);

even though… - Acquiring a new customer is 5x as expensive as retaining an existing customer;

but still… - 89% of businesses, “see customer experience as a key factor in driving customer loyalty and retention.” (source)

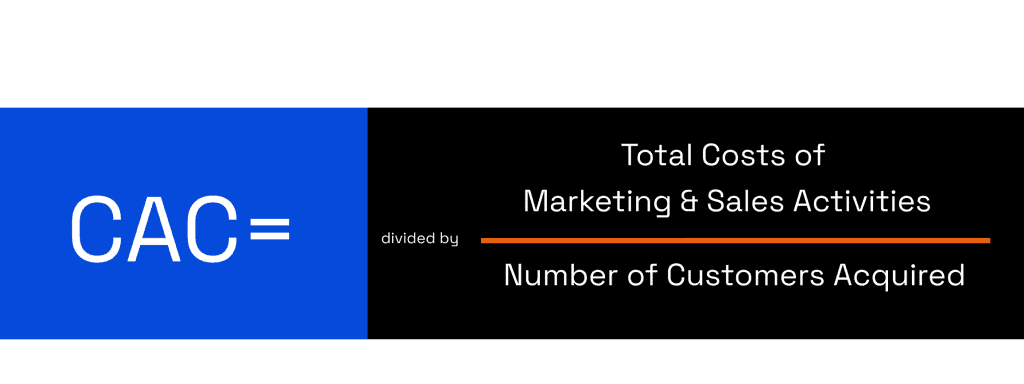

Aware of their interconnectedness and complexity, we at Sales.Rocks try to balance them by keeping the Customer Acquisition Cost (CAC) at minimum.

over a Certain Period of Time.

CAC will always be one of the most important SaaS Sales metrics to track. It hits us with the hard truth of how much it costs to acquire a new customer or user for our SaaS.

Want to

Learn more?

And get access to Sales.Rocks Academy.

To spill the beans…

How we manage to keep the Customer Acquisition Cost at a minimum?

Sales.Rocks is a relatively young SaaS company (launched at the end of 2019), and yet it shows great results in the rate of growth and performance metrics.

The secret ingredient to our success is the sales and marketing automation tool we use.

For lead generation and prospecting, we – the Smarketing team, are lucky enough to have access to a huge B2B database containing accurate, GDPR compliant business information about companies and contacts from over 213 countries and regions. p.s. this allows for measuring Sales by Region, should you want to add that metric into the sales mix.

And that data is regularly updated.

With all that information at our disposal, we use the powerful filtering system of our sales & marketing automation tool that additionally enables us to filter down and source out all the relevant information we need about our Ideal Customer Profile.

The information includes:

All registered companies in any industry of our choice (our target market), company’s name, HQ’s location, company’s turnover, the employee range in the hierarchy of the company (full Company Organizational Tree overview of all employees), business email address and phone number, company’s website + the technographics (the technologies they use).

And as the cherry on the top 🍒

– this database even provides company’s logo as an image. (This comes in very handy in our hyper-personalization efforts!)

The platform delivers straight in our hands the email addresses of almost every employee within any of those companies, their LinkedIn profiles, their job title and position, personal name, including the department they work in. You can find here all the data points we have at our disposal.

The best part is that this sales and marketing automation platform I’ve been describing above, to which we owe our rapid revenue growth and success is our own product. Developed in-house. We are our own favorite case study (and I guess it shows).

Thanks to Sales.Rocks, we managed to shorten our average sales cycle against the industry’s sales benchmark.

Getting back to reducing the CAC, we take into consideration the average selling price of services similar to ours and go the extra mile to provide our clients with the best price for quality in the industry.

According to G2 crew, Sales.Rocks has the Highest Return on Investment (ROI) compared to our top 10 competitors in the industry. If you want to try it, you can create an account here, our V2 is live.

How do we make that possible?

A word on our Marketing effort.

While there are other ways in which you can optimize your SaaS spend, going full organic allowed us to save on marketing costs and keep a healthy cash reserve.

In doing so, we are able to give our clients a fair price for our solution.

If CAC is total Costs of Marketing & Sales Activities divided by the Number of Customers Acquired… our “cost” of marketing activities (such as Ads) is reduced to a minimum.

This allows us to transfer that “potential investment in Advertising” where it truly matters =in offering an affordable price for our clients by reducing the cost of customer acquisition.

Focusing on SEO (organic🌱) instead of PPC, we are able to reduce the CAC, cost of acquisition of our customers, and therefore “lower” the price of our solution for the same amount of cost that would have been spent on Ads instead (to target you, our favorite audience).

Increase your revenue with Sales.Rocks!

Get ROI in the first few months and double your revenue with a sales and marketing automation platform you can rely on!