Updated on June 6, 2022

It’s a tale as old as time.

Everybody’s ultimate goal in business (and life in general if you ask me) should be the Return on Investment.

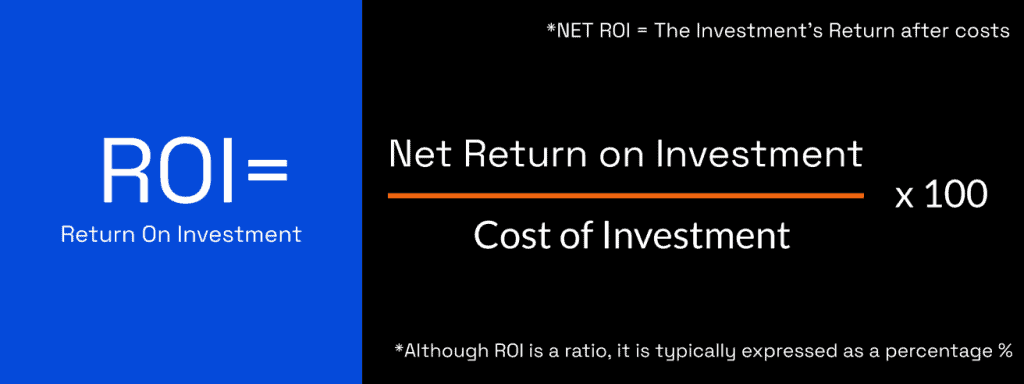

Return on investment (ROI) is a performance metric that is widely used to measure and evaluate the probability, efficiency and profitability of gaining a return from a resource investment.

How many resources in the form of

– Time (my favorite currency),

– Effort and Energy (second favorite) and

– Money

…are you investing in the work you do to achieve a certain goal?

Whether it be to get your body and health into shape? And your life, team (or mind) more organized; Or to develop and grow your business by getting actual results from the work you do?

Each to their own. I’m not judging. ¯\_(ツ)_/¯

But, do you consider things like how much benefits/progress/success do you get out of your “resource investments” in the end? Do you measure them?

Are your investments producing a profit or a loss? How do you balance that?

ROI is a ratio that compares the gain+ or/ loss- from an investment relative to its cost.

“ROI is calculated by subtracting the initial value of the investment from the final value of the investment (which equals the net return), then dividing this new number (the net return) by the cost of the investment, and, finally, multiplying it by 100.”

— Investopedia

If there is no equal give-and-take between what you are giving vs. what you’re taking (as a result), then where are you going?

In the wrong direction.

In the same manner, if your compass points towards Revenue all the time, and you blindly focus on net-new customers and prospects, you can’t see clearly how the business machine works at its core.

🔴You might have a huge hole in the core of your business from where your already subscribed customers are leaking. They are leaving your product and services because they are dissatisfied while you are chasing after net-new revenue and net-new customers. This is your CHURN rate = the rate at which customers stop doing business with an entity.

It’s not the revenue you should be looking at.

Revenue is fluctuating. It’s not stable. You can’t base all your decisions blindly focused on increasing the revenue. Not before you understand the interconnectedness of all the small details that play their part in increasing the revenue – sustainably and organically.

At least, this is true for the B2B SaaS community, where the growth and the progress of the company depend on the loyal customers that keep paying their subscription month over month and year over year.

We have already written a provocative article on SaaS Sales Metrics – How do you know whether you’re winning or not, if you’re not measuring the right KPIs and getting sustainable results?

And I highly recommend reading it.

To be able to make a decision, first, you need to see things clearly. Then, you know where to focus your resources.

That’s what we’ve been trying to do here at Sales.Rocks. And here below is our result. But let’s first understand how it all works.

While you are marching after revenue, are you aware of how much money you’re wasting on your way there? It’s counterintuitive.

From what I gather, currently, ROI on CAC is trending in the B2B environment.

Let’s take a look at that.

Return on Investment (ROI) from Customer Acquisition Cost (CAC)

What do we actually mean when we use the term Customer Acquisition Cost (CAC)?

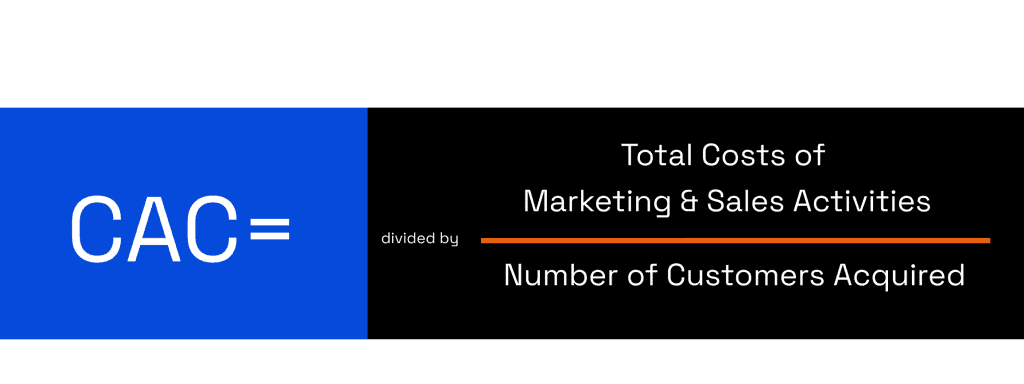

CAC is the cost of convincing a potential customer to buy a product or service from your business. It is the total sum of all the money you invest to attract and acquire your customers divided by the success you had in acquiring those same customers. It helps measure the return on investment of efforts to grow your customer base.

And it’s kind of my favorite formula. I’ll tell you why later.

Why? Oh well because the use of CAC has become quite popular since organizations started using web analytics to make data-driven decisions. 🌟 Bling-Bling.

🧲 Paying to make potential customers click on advertising banners that show when you visit a website or simply scroll on social media;

🧲 Investing in PPC Ads (they pay Google to show their Ad as the 🌟first result🌟 when we search for something related to their business);

🧲 And even on Youtube. Those video ads that pop up before /in the middle/ or at the end of a video you chose to watch? Pay for them as well.

Lots of investments to be tracked and measured. To measure their CAC and help themselves figure out if they’re getting their money’s worth as they invest in growing their audience and client base.

What some Marketing Teams won’t tell you? 🔮

IF we need to invest more money, time, and effort into acquiring new customers for our product -> by paying more people (employees = cost) that will then be paying Google and Facebook ads (PPC marketing = investment) to target you (suspected ideal customers) that would be interested in our product, then be it.

BUT once we invest so many resources (money especially) into acquiring those few new customers [out of the whole pool of what we initially thought are our suspects], we gonna make the access to our service (or the price of our product) so high! even double it, triple it if needs be – so that at least we return our investment on ZERO (0) ground again.

And make a profit along the way.

Ok.

Then where is this profit coming from? Well… from those few customers that chose to give us a chance and subscribed to our services.

They will have to pay for all the resources we spent on the whole campaign to find and target what we believe are our potential and ideal customers. (= gain?)

Easy to digest, right? But is that fair, really?

All those money spent to attract their customers and then ask them for their money back?

This huge leap of price value between what the product really costs and the added cost of the “burden” of acquiring the customers should be settled by those that actually said yes to your offer?

I don’t think so.

Therefore, at Sales.Rocks, our philosophy on this matter is a bit different.

We believe that a great product and service is built over time by equal participation between the teams behind any SaaS business and their current customers.

We listen to pains and we deliver solutions. You tell us what is not working, and we fix it.

Not in a hurry, as long as we know that we are going in the right direction and making progress as a community, not as a company vs. its customers.

So when it comes to ROI on our CAC we are always on the positive + side. Sustainably even.

📌 Sales.Rocks has been officially recognized as having the best ROI of any Sales Intelligence software, by the most trusted peer-to-peer review community in the world of business software and services based on user ratings and social data – G2.

And this is kind of a big deal because it is not easily achieved. It is only us – Sales.Rocks, that can boast with Best ROI from all the competitors.

This ROI refers to you – our customers. This ROI is YOUR return on investment from choosing Sales.Rocks as your Sales Intelligence software over all the others on the market.

Our customers are getting their money back from what they are paying to be subscribed and use our software.

What does it take, you ask?

It takes pure intentions and critical thinking. Not just running in the same direction with all the others.

Let me explain.

Have you ever wondered why you’re seeing these ads, and what the advertisers are trying to achieve?

You are seeing these ads not because you are necessarily looking for the products, but because you fit a certain audience segment that the advertisers believe that you are likely to be interested in them.

The hypothesis is, if you don’t know about a product or service, you won’t look for it nor buy it. So the first step to convincing you to purchase is to make you aware of their offering, and how it can benefit you.

And there is nothing wrong with it. Up to the moment when they decide to ask the money they spent on Ads back from you. To balance their CAC.

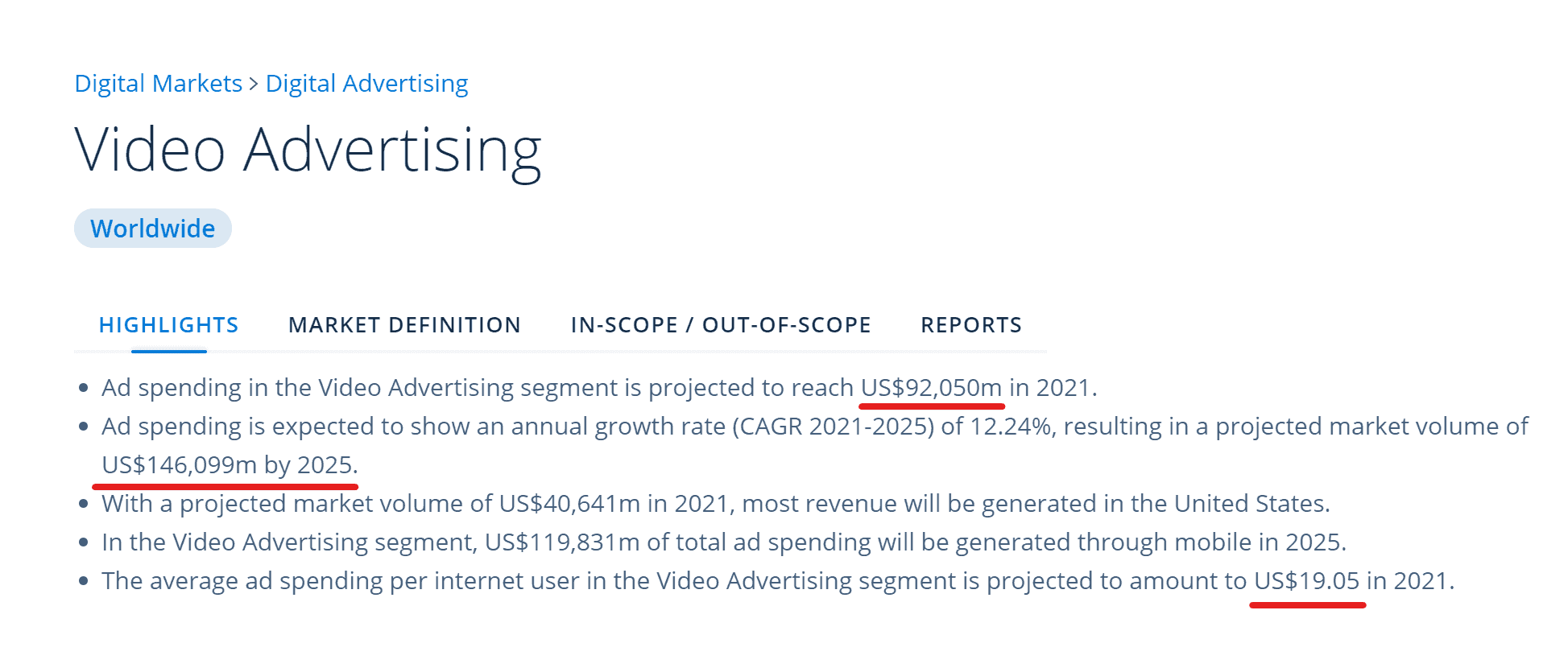

If the average ad spending per targeted internet user is $19, and let’s say they target 2,000 potential customers:

2,000 x $19 = $38,000.

Ok, so they spent $38,000 on Customer Acquisition Cost (just from video and display advertising).

Well now, how will they get their Return on Investment from CAC? From acquiring, let’s say, 500 customers out of those 2,000?

💡 By increasing the price of their products and services right?

Well, how did we at Sales.Rocks, manage to keep our CAC on a minimum and at the same time acquire not only loyal customers but also this Badge of Honor and official recognition for delivering a Sales Intelligence Software that brings the best ROI (Return on Investment) back to the hands of the people that chose us?

What does it take?

It takes a devoted team to serve those people that already look for a solution to their problems – by themselves.

Therefore, you won’t find Youtube nor Display Ads with the Sales.Rocks logo on it. (We use paid advertising only to inform you if we have a promotion.)

We prefer to keep it organic. 🌱 Therefore, we rely our marketing efforts heavily on SEO, of course.

Besides, we understand marketing.

“80% of users ignore paid ads and go for the organic search results”

— Source: Imforza

This allows us to keep our Customer Acquisition Cost to a minimum.

We simply write articles (like this one), filled with transparency and valuable information. We share knowledge from our personal experience and that of the other industry experts.

If Sales.Rocks’ article is shown to you on Google while you perform a search query – it will be in the organic results.

Yes, we talk about our Sales Automation software a lot, but only to those of you that come here by your own interest.

We believe that those who are looking for a solution to their business pains – will find the right solution by themselves.

“75% of customers use more sources to examine and assess their B2B purchases”

— Source: Blue Corona

“77% of B2B clients perform a comprehensive ROI analysis before buying”

By choosing NOT to invest a large sum of money to show you targeted Ads and invite you to buy from us, we are able to transfer that same amount of money into offering you a fair price for the quality of our product.

See the difference?

If we are not spending a fortune on Customer Acquisition Costs, we don’t really have a massive burden on our shoulders (e.g. $38,000 ) to get back that Return on Investment, by making our newly acquired customers pay more than what they get.

That’s how we got this badge and now we wear it proudly.

Our biggest Return on Investment is found in the value our customers receive for the price they pay to use our services, and their patience while we build even better solutions.

Join us today!

And drive even more revenue

from your investment.