Updated on March 2, 2023

There are so many great products and services that fail due to customer churn or the lack of traction.

In 2020, almost 90% of all new startups failed, which clearly shows that having a great product might not be enough;

This usually happens when instead of recognizing it as a priority, startups skip developing a go-to-market strategy (to save budget) and jump into the market with assumptions.

What is a GTM strategy?

A go-to-market strategy is a plan that outlines the tactics and activities a business will execute to effectively launch and position its product against competitors when entering a new market, or when launching a new product in the same market.

The goal of a GTM strategy is to help you:

- Gain an understanding of your target market, audience and your product’s place in it;

- Keep marketing costs down by identifying the channels with the highest return on investment (ROI);

- Develop strategies and work on product positioning and messaging before going to market;

- Define distribution and pricing strategy before launch to ensure maximum market impact.

All in the effort to achieve an optimal product-market fit and communicate effectively how you want users to think and feel about your brand in your target market. Down the road, you will be able to craft new buyer behavior that involves your product and shorten the sales cycles and enjoy sustainable ROI.

A successful go-to-market strategy involves a mix of:

- setting objectives,

- combining different strategies

- executing tactics, and

- measuring, analyzing, and optimizing KPIs for high-level business results.

When you get your GTM strategy right, execution becomes 10 times easier, steering your SaaS in the right direction and helping you to grow and scale your business faster. It will align all departments and establish a timeline to ensure each stakeholder meets the defined objectives and outcomes, paving an attainable path to market success.

How to Build a Go-to-Market Strategy for Your Startup

In the past few years, I had the chance to collaborate with experienced mentors on creating GTM strategies for new startups entering the market and assist in successfully executing them.

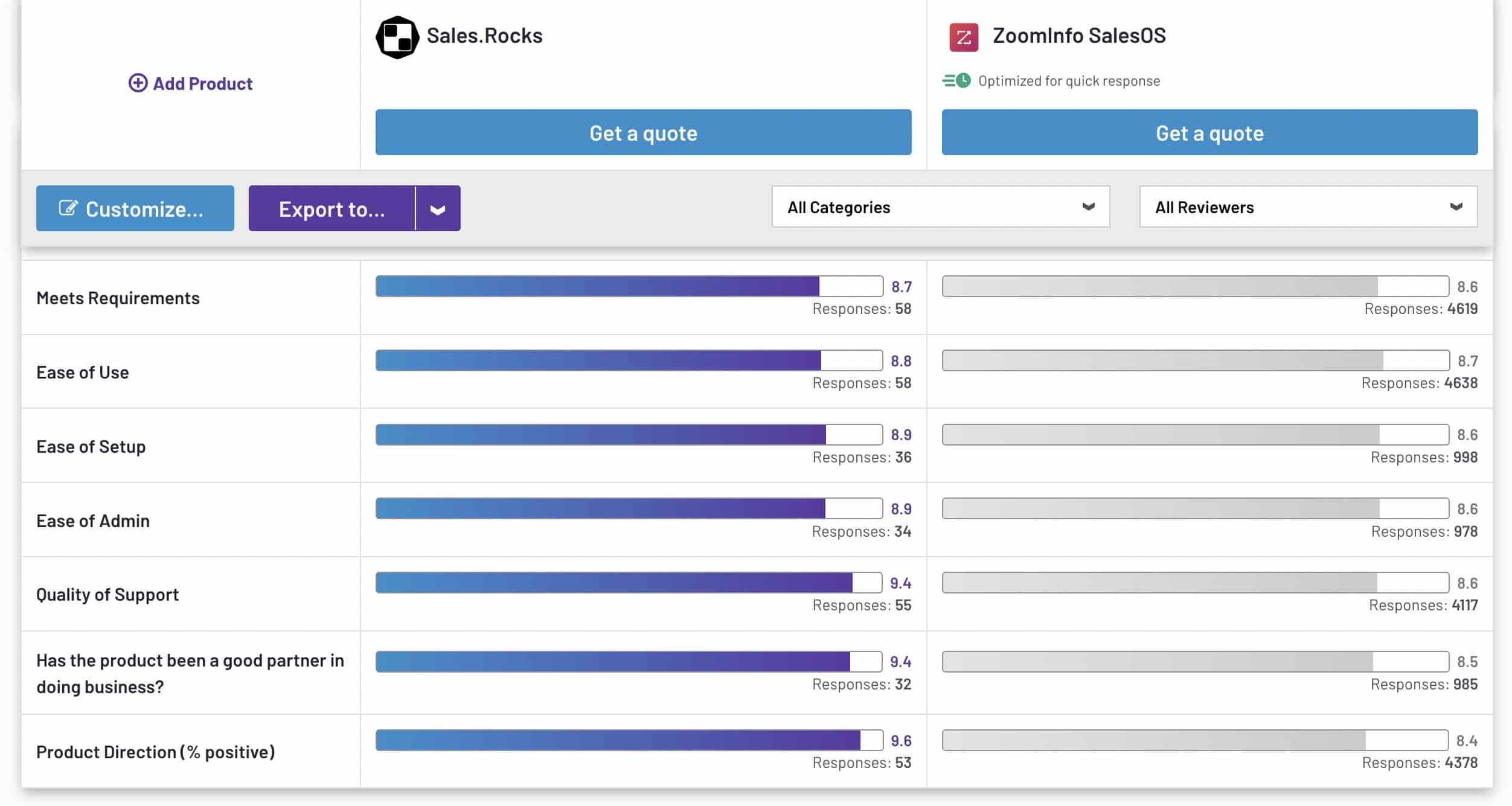

One of them is Sales.Rocks, which today enjoys a good spot in our niche and regularly receives the prestigious award from the G2 community for best-estimated ROI from any sales intelligence software on the market.

Related read: ROI (Return on Investment) in B2B SaaS: What does it take?

Here’s our approach to creating and executing a go-to-market strategy, by covering the process step by step.

The four core components of a go-to-market strategy

Before we really dive deeper into strategy, let’s first understand the core elements of GTM

strategy development so you can easily create one for your unique business needs.

There are four of them:

- Researching your target market, audience, competitors, and industry;

- Planning & developing marketing, sales, and pricing strategy to enter the market;

- Positioning – setting objectives to position and solidify your brand in the industry;

- Executing tactics so you can reach every objective and cover every aspect of your GTM strategy;

In a successful go-to-market strategy, the four core components – product, price, promotion, and place – must be aligned with a well-crafted digital product strategy to launch and market a product to the target audience effectively.

#1. Research: The Backbone of a GTM Strategy

The purpose of research is to learn as much as possible about your target market, industry, audience, and competitors before developing a strategy – so you can make data-driven decisions.

Without research, we’re practically jumping off a cliff into an unknown abyss.

When marketing teams are blind to the state of their target market, companies lose even that little control they have over the outcome of their marketing efforts and return on investment.

The research phase plays a key role in opening the eyes of B2B sales teams to their ideal customer profile (ICP), business growth potential, and customer pain.

Conducting thorough research ensures that your strategy will be reasonably built upon insights instead of assumptions alone.

Your research findings will guide you to:

- make an informed go-to-market strategy;

- achieve product-market fit;

- improve the conversion rate;

- reduce customer acquisition costs, and

- optimize your overall customer lifetime value.

Key research activities

These research activities are intended to help you gather key insights that will guide your strategy and pave the way to your market entrance on stable ground.

- Research mapping: Decide on all the data points you will use to inform your strategy;

- Analytics: Analyze your existing data on existing channels & customers to spot the positive and negative trends and allocate your resources where it makes the most sense;

- Audience research: Find out as much as you can about your target audience, to catch their attention, speak to them effectively and bring your brand closer to them;

- Competitors research: drive insights into where you stand among competitors and what’s working for them so you can try to leverage that tactic or channel as well;

- Keyword research: Understand what topics are currently trending in your industry, what your potential customers are searching for on Google, and what type of content performs best with them for your competitors;

- Social listening: Observing how people talk about your brand, category, product, or industry on social media and measuring the awareness level.

Ok, so how to do market research? Where do you start?

Market research:

Identify the awareness level

First, you need to identify the awareness levels of your product in the market.

“To earn customers you need awareness. To earn awareness, you need marketing.” – Rand Fishkin

Market and keyword research, combined with social listening will help you achieve exactly that.

Market research involves gathering information about your target market to verify the success of launching a new product or help your team iterate on an existing product.

There are many tools to help you perform market research, but the most essential are:

- Statistics portal for market data, market research, and market studies (e.g. Statista);

- B2B data provider to get business information on target accounts in your market (e.g. Sales.Rocks or Crunchbase);

- Market research platform for sending customizable surveys to focus groups among other activities (e.g. SurveyMonkey);

Additionally, you can make use of the Think with Google suite of free tools, such as “Market Finder” and “Find my Audience”. But if you’re ready to invest and feel like you could use a helping hand, consider WARC.

Keyword research will help you determine the awareness level by using your brand name or product type in tools like the Google Keyword Planner or Google Trends. They’ll show you the approximate number of audience that is familiar with your brand, or at least with the type of product or service you provide. From the premium tools, I highly recommend Ahrefs for keyword research and all things SEO.

Search keyword tools can tell you what people are searching for, but they can’t tell you who is doing those searches. Enter: audience research.

Through social listening, you can see who’s talking about what online. And through SparkToro, you can see this data on the aggregate level — including their demographics and how they self-identify.

The free audience listening tools I frequently use are Answer the Public and Soovle.

If the results from your findings are low, the next step is to make people aware of the existence and benefits of your product. So one of the main objectives of your strategy will be raising brand (or product) awareness.

Audience Research:

Figure out who your customers are

“Audience research is the art of converting prospect data into customer wisdom.” – Flint McGlaughlin

It involves gathering specific insights into your target audience that will later guide your marketing campaigns and sales activities. Audience research helps you to identify the interests, pain points, preferred marketing channels, and firmographic identities of your prospective customers.

This information allows you to build a clear picture of your ideal customer profile (ICP), place their business into context related to your product, and gain insights into where you might reach them to deliver on your goals.

Your ICP is a detailed description of the perfect-match customer for your B2B SaaS solution.

The kind of customer that you had in mind when you came up with the idea for starting a business.

In B2B, these customers are the business professionals working in your target companies. They will be most interested in your offer and will enjoy the greatest benefit from your SaaS in the market you’re entering.

Meaning – they’re most likely to convert into paying customers.

Top 5 Questions to help you define your ICP

1. Who can I serve better than anyone else? = Ideal potential customers;

2. What are their common characteristics and challenges that my solution can help them solve? = Customer pains;

3. What are the main benefits they should expect to receive from my product or service? = Customer gains;

4. Justification: Why would this person choose my offer over every other? = Your Unique Value Proposition;

5. Stylization – How can I best communicate to this person in the language they already use? = Brand voice and positioning.

Further read: Firmographic Segmentation: Nail down your Ideal Customer Profile in B2B

Ultimately, your product should boost their bottom line, by:

- Helping them overcome a specific, everyday challenge they face;

- Reducing their costs or minimizing the time they spend to perform tasks by automating the process;

- Improving the productivity and efficiency levels of their teams, etc.

In return, by becoming subscribing customers, they will give you enough value back in the form of revenue, referrals, reviews, and testimonials, while keeping your business profitable.

Competitors Research:

Assessing Business Risk

Understanding where your solution fits in the existing landscape of your new target market is key to any GTM strategy.

That’s why learning insights about your competitors helps position your own product.

Key benefits of competitor research:

- Compare channels. What social networks are they utilizing?

- Identify channel gaps. Are there channels that are not being used, and is there an opportunity?

- Content assessment. What blogs of your competitor’s content bring them the most traffic?

- Assess format gaps. Are there specific formats on specific channels that are not being utilized?

There are different approaches to conducting competitors’ research, but here’re some recommendations to get you started:

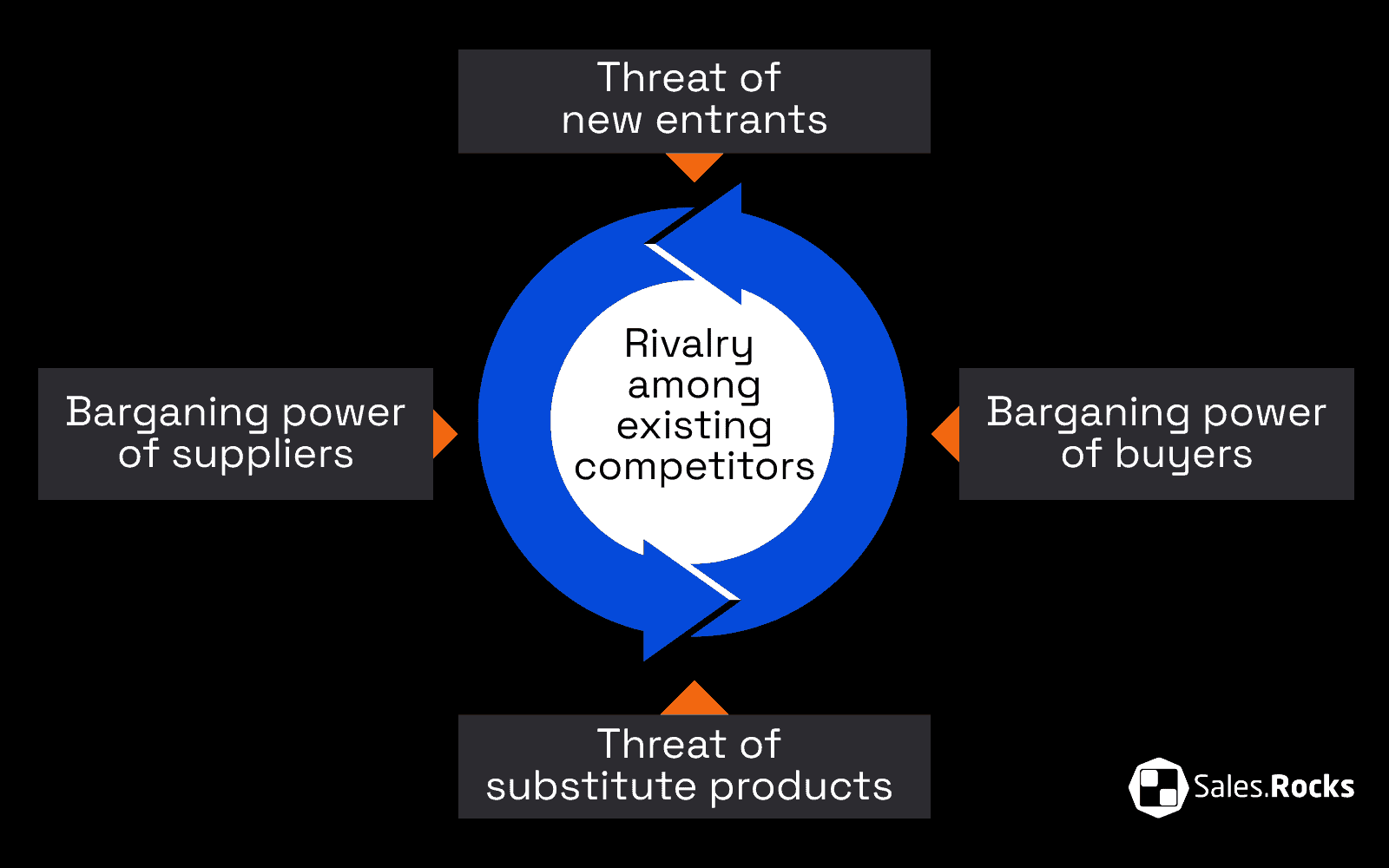

Porter’s 5 Forces

One good analysis method is the “Porter’s 5 Forces” that helps us visualize mentally the attractiveness of a particular industry, measured against key factors like barriers to entry, customer and supplier bargaining power, and the threat of substitute products or services.

The Competitive Forces Model is an important practice used in strategic analysis to get an idea of the competitiveness in a certain industry. It includes the following five forces:

- The intensity of rivalry;

- The threat of potential new entrants;

- Bargaining power of buyers;

- Bargaining power of suppliers, and

- The threat of substitute goods and/or services.

If you want to dive deep into the subject, here’s a detailed explanation and example of using Porter’s 5 forces.

Analyze the G2 Community

G2 is the most trusted peer-to-peer review community in the world of business software and services based on user ratings and social data. At the same time, that makes it the largest and most trusted software marketplace where you can identify your competitors by category, features, services, or size. (e.g. SME, mid-market, or enterprise.)

You can see feature-by-feature comparisons between two different competitors, (or your own software VS. alternative once you have it listed on G2.)

Once you have identified them, start assessing the reviews they receive from customers to figure out what they like and dislike the most about competitors’ platforms and what sets your solution apart.

How can your solution tackle the issues they’re experiencing with competitors?

For example, while most Sales.Rocks competitors offered either just B2B data or just a cold email outreach tool, we built our software upon a huge B2B database and included LinkedIn in addition to email for multichannel outreach using both channels simultaneously.

Budget Planning

The problem with budgets is that you need to plan for how much money you’re willing to invest over a given time.

Essentially, budgets comprise media costs, creative production, agency fees, and digital tools and technology for the purpose of delivering on a campaign or strategy. Additionally, staff costs, training, and processes can be included as part of the overall budget though this isn’t always the case.

Your budget is directly dependent on what factors are influencing these areas.

People: Questions that can arise include, “Do you need a larger team? Do you need specific skill sets within your team in order to achieve what you feel is the right way to approach it? Do you need to adopt a new process of piece of technology to improve your results?”

Technology: Technology, particularly in larger teams, really helps to improve efficiency. How you achieve efficiencies is by examining existing and new tools to make sure that the teams are linking in with each other correctly, that they’re sharing data and insight correctly and accurately. So, it’s important to recognize at what point you need to invest in these should you find reasons to address possible inefficiencies.

Training: Training must not be overlooked! You should be asking “how much training does your team require? How much do you need to upscale your team?” It’s important to recognize this early because it’s often something that falls by the wayside. If you find inadequacies, then you should try to remedy this as soon as possible.

Process: What volume and detail are required in your ad buying strategy? If you have a high investment in media, in advertising, in paid ads, what you’re going to find is that it’s going to require more tools and more people to actually manage that advertising.

Key considerations:

- How many people are in your target audience?

- What are your objectives?

- How many people could you really make customers?

- How much money are you willing to invest in digital?

- Have you allocated a budget to cover busy months or campaigns?

- Are you allocating enough ad spend?

- Are you under-investing and limiting your impact?

Return on Investment (ROI)

ROI is one way of measuring the success of a campaign or strategy. Another approach is to look at other valuable actions, such as micro conversions. Micro conversions are the actions that a user takes that contribute to the purchase decision-making process. ROI can be a monetary value but might also apply a value to a specific action – for instance, site visits, inquiries, and video views.

Further read: ROI (Return on Investment) in B2B SaaS: What does it take?

Brand (/Product) Positioning

Product positioning frames the brand’s identity, mission, and differentiating features within the context of the buyer’s experience.

When it comes to positioning your product in a new market or launching a new product in the same market, you’ll need to adapt your brand voice to speak directly to this new tribe of ideal customers you’re approaching.

The best advice is – “Make your voice – their voice!” and it comes from one of my favorite mentors on copywriting – Joanna Wiebe of Copy Hackers.

The more likely you are to adapt your brand voice to theirs, the greater the opportunities to find yourself in conversations with them and start building relationships with customers.

People want to believe in the brands they buy from, so think about how can your brand be the voice of that group of people in your specific niche.

When you have finalized the research phase and gathered all the insights, now you can start writing your positioning statement.

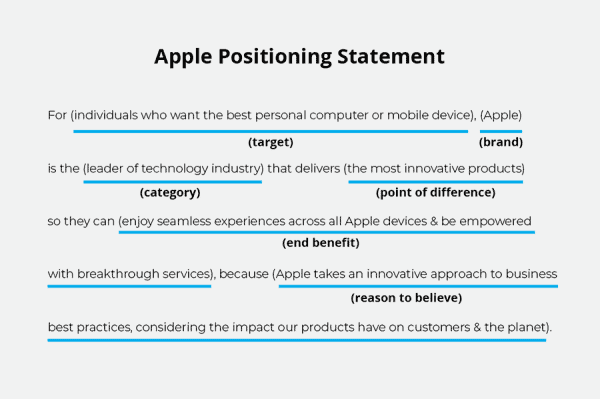

Positioning Statement vs. Mission Statement

A mission statement is the vision and purpose your business serves in the market — and a life-long journey of commitment to fulfill that vision. When analyzing the “what, why, and how” of your business plan, the mission statement should give you the “why” while the positioning statement will answer the “what.” What is your area of expertise? What do you bring to the market?

Position Statement Template

For [your target market/audience] who [struggle with X challenge / or need X], [your brand name] provides [your USP – the main benefit that differentiates your offering from competitors] because [reason why they should believe your statement.]

e.g. Apple Positioning Statement

Setting strategy objectives and KPIs

business objectives that can be realized through digital marketing, for example, increase e-commerce sales, drive more leads, and build audience engagement with your brand. The objective phase should be focused clearly on beginning with your key success outcome and then identifying your KPIs. Once you have achieved this, then you can begin designing a strategy that is measurable and clear.

Being clear and concise is crucial. You have got to make use of all your resources in an efficient manner; know where your money is best spent and try to minimize budget waste.

Some key objectives throughout a GTM marketing strategy are:

- Awareness: This is about audience reach

- Conversion/sales: That is commercial success.

- Consideration: That is evaluating if the product or brand meets your needs.

- Retention: This enables you to establish customer engagement.

Business performance is an important expectation because it is often misguided in solely looking at direct sales. Outside of just focusing on sales, it is important to understand success can also be measured in leads and engagement. It’s important to know what metrics or KPIs are most suited to measuring the success of your overall strategy as well as the different channels that make up the strategy.

- PPC and SEO, when used as conversion channels, can be measured in sales or leads delivered;

- Email and Mobile Apps when used as customer retention channels can be measured in customer retention, repeat use, engagement, leads, and sales;

- Display and Social media when used as awareness channels can be measured in reach and engagement.

When you understand what the measurement and goal of a channel is, you can use diagnostic metrics to evaluate success even further. Some examples of metrics used to diagnose success include:

- CPA and CPL for conversion channels

- Sentiment and Awareness for customer engagement channels

- New versus returning users and increased sales or conversions for customer retention channels

Setting & Measuring KPIs – Key Performance Indicators

“Key Performance Indicators (KPIs) are metrics that combine to deliver on wider Key Success Outcomes (KSOs). KPIs are used to measure the effectiveness of content, channels, and activity in delivering your goals.” – Digital Marketing instutute

So it’s kind of important to decide upon and set meaningful and realistic KPIs by clearly understanding what SaaS sales metrics are available and best suited to measure your GTM strategy performance.

To understand better the SaaS sales metrics so you can better measure them and optimize for the right ones, read this: Are you winning? 5 Brutal Truths about Saas Sales Metrics

And from a marketing perspective, you can measure awareness channels like display and social with assisted conversions, reach, and frequency, while PPC and SEO are conversion channels and can be measured in:

- The number of leads or sales driven;

- Cost-per-acquisition or lead;

- CPA/CPL or conversion rates;

Choose the right metrics for your unique business needs by analyzing and setting the right KPIs related to those metrics.

Reporting vs. measurement

Reporting and measurement are often seen as synonyms, so it is very important to identify the difference from the start.

Reporting requires understanding and translating the performance metrics into achieved results. It’s a benchmark of how certain tactics are being performed at a given time frame (day, week, month, quarter, or year). It enables us to see the bigger picture of how a particular task or goal was achieved. Reporting is for the management level to ensure work is operating smoothly following the strategy.

Measurement, on the other hand, is how senior members of the team identify specific metrics to optimize and improve and how they will impact the bottom line. It is a specific set of metrics that can be used to measure business performance over time.

Assigning responsibilities for executing your go-to-market strategy

As part of the strategy execution, you need to address the following questions:

- Who identifies the patterns of success?

- Who ultimately makes the decision for change?

- Who is responsible for setting the objectives?

- Who tracks performance?

Without accountability, there is no guidance. Everybody in your team should understand:

- Who is responsible for what;

- What are their main KPIs at team level;

- What are the next steps and how to successfully reach them;

- What are their weekly/monthly goals;

By defining specific KPIs and measuring performance against these KPIs, you can ensure you are on track to deliver your goals.

Setting channels & executing tactics

Outbound (Sales)

Outbound prospecting is performed by your SDRs and it involves finding & reaching out to potential customers who haven’t yet expressed an interest in your product or business, but you know that they can benefit from your solution. It is the first step in the B2B sales process and according to 40% of salespeople, prospecting is the most challenging part of it.

That’s probably because 42% of sales reps feel they don’t have enough information prior to making a cold outreach.

The channels we use to reach prospects are cold calling & cold emailing. With the right B2B data and cold outreach software, the process becomes much easier (thanks to sales automation!) and quite more effective.

If you want to dive deeper into the subject, watch this webinar.

When starting out, you might have two or three outbound SDRs working on your sales team.

They will require 3 things:

- Training support (including a sales playbook for your specific business);

- Sales tools (such as CRM, cold outreach software, analytics, reporting, etc.);

- B2B data (company & contact information, including phone numbers & email addresses);

By preparing a review of the number of cold emails and LinkedIn messages your SDRs send per day, you can track their performance and the results they receive, so you know what works and invest more effort there, and also what doesn’t – so you can let it go.

To find out how many prospects you need to reach your sales target, divide your sales goal by your “close rate”.

Close rate is the percentage of contacted prospects that were successfully turned into paying customers. You can calculate your close rate by dividing your total sales by your total prospects over the past month.

For example, if your goal is 10 sales and your close rate is 10%, you can divide 10 by 10%, which equals 100. So you need around 100 leads, at a 10% close rate, to get 10 sales.

Use this forecast method to inform your reps’ targets.

If you notice that they’re a long way off the set monthly targets, you may need to adjust your go-to-market strategy or invest in their skills and resources.

Inbound (Marketing)

Inbound is the opposite of the outbound approach. Instead of reaching out to prospects, the B2B marketers attract customers to your website and social media by creating valuable content that answers their questions and pain points so they find you themselves when searching for answers.

The marketing team then tracks and analyzes the buyer behavior of the inbound leads, acts on the findings, and performs lead segmentation to divide them into qualified leads and non-qualified ones, so they know where to focus their marketing efforts.

Here’re some tactics to get you started:

Launch your product on ProductHunt

Product Hunt is a popular community-based platform and a great place to get some attention for your startup and be discovered.

It allows product owners and marketers to launch their software or mobile apps and other tech products, and get in touch with their first real users! The community will engage through votes and (honest) reviews, which are essential in the early stages of executing your GTM strategy.

Every day, the top five best-performing products are listed on the homepage and if you manage to position your product on this list you will easily generate buzz and get early adopters.

List it on G2 crowd – the “Amazon of business software”

We already mentioned the G2 crowd when we discussed competitors and market research, now is time to suggest you list your software on their platform and start positioning it against the other competitive products in the same niche.

Start by creating an account here, and submit your new listing. Shortly after that, you will be contacted by customer service and you will be guided on how to better position your company and products.

The platform is used by over 60 million software buyers annually and boasts 100,000+ software and service companies in more than 2,000 categories with over 1.5 million trusted users that leave their peer-to-peer reviews.

Nearly 60 percent of the Forbes Cloud 100 are G2 customers including Adobe, Autodesk, HubSpot, Salesforce, and Zoom.

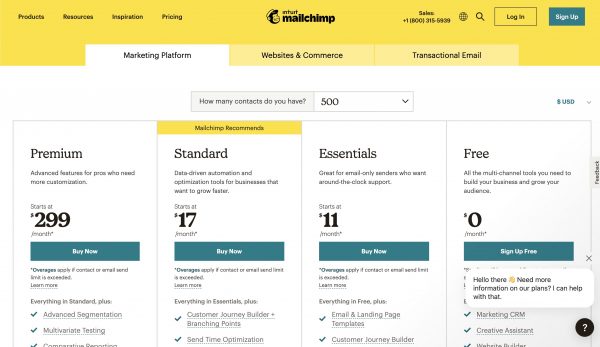

MailChimp: One of the best Go-to-market strategy examples to inspire your own!

MailChimp is a successful SaaS company about all things email marketing, and its services are the best in the industry in so many ways. Therefore their go-to-market strategy (and execution) is a great example that we can all learn from.

MailChimp set its initial focus on the marketing environment for small businesses. They had a solid plan because small businesses account for a significant chunk of the entire American market. This niche helped MailChimp expand into the dominant email marketing force we know and rely on today.

“Every time we sat down with potential investors, they never seemed to understand small business. Everybody we talked to said, ‘You’re sitting on a gold mine, and if you pivot to the enterprise, you could be huge,’ but something in our gut always said that didn’t feel right,”

Mr. Chestnut said in an interview for the New York Times.

Going from paid to freemium; they made a great marketing decision!

Unlike other popular Silicon Valley businesses, MailChimp didn’t begin as a free version or even a freemium one. They actually used to bill their clients for the services they received for almost eight years.

However, things changed when MailChimp introduced a freemium option for their products in the last quarter of 2009. According to Ben Chestnut’s post on the company blog, the number of clients increased five times in a single year, from 85,000 users to 450,000 people.

An amazing example of how a “tiny” modification can cause a big shift in a business, transforming it from “just another startup” to a market leader overnight.

Proximity to the customers

When MailChimp started executing its GTM strategy, there were already too many rivals on the market. And we’re not talking only about small businesses with a dozen or fewer people; we’re referring to competitors with larger budgets and stronger financial positions.

According to Chestnut himself, as quoted by the New York Times, all of these rivals lack something that MailChimp has from the beginning: proximity to its customers.

„Because MailChimp was itself a small business, it understood what those businesses wanted out of their marketing tools. Its offerings were cheaper, it added features more quickly, and it allowed greater customizations to fit customers’ needs” – NYT article.

Content marketing

The most effective and affordable strategy to increase awareness and, at the same time, keep your customers interested and engaged when it comes to brand development and product marketing is through content.

We’re referring to useful information that a business posts on its blog, website, or YouTube channel. This tactic was nothing new to MailChimp.

Their site is often updated and is jam-packed with useful content for small business marketers, including lessons, company and market news, suggestions, and a variety of other informational items.

In addition to the blog, there is another significant element in their website design related to content – Learning Resources.

This section, which also includes useful information for their clients and occasional readers, primarily focuses on tutorials and other learning tools that may aid in their understanding of email marketing in general and the products and services of MailChimp in particular.

Conclusion

Building a go-to-market strategy is essential before taking your new product to market.

With the steps I shared in this in-depth guide, you’ll be well on your way to launching your brand new product or service in your target market and becoming profitable in the marketplace.

MailChimp provides a wonderful illustration of how to tread lightly and sell a brand subtly by coming up with novel, unconventional concepts.

Even though it is now a giant in the field of email marketing, creating a business of this size was neither simple nor quick.

In designing your own distinctive go-to-market initiatives, I believe we can all take a few cues from MailChimp and from what I shared with you above.

Until next time 🍀